Diminishing value depreciation formula

For the first year depreciate using the rate youve identified and the assets cost value how much it cost you to buy. Rate Adjustments - Diminishing Value Depreciation Method Example.

Depreciation Formula Calculate Depreciation Expense

You might need this in your mathematics class when youre looking at geometric s.

. What OOB depreciation method can be used for the diminishing-value method straight-line rate multiplied by 200 for depreciating assets - Base value days held 365. Deprecation Value 10000 - 1000 10 90000. The diminishing value method allows for a higher depreciation deduction of the asset in the first years of ownership and then reduces over its effective life using the following.

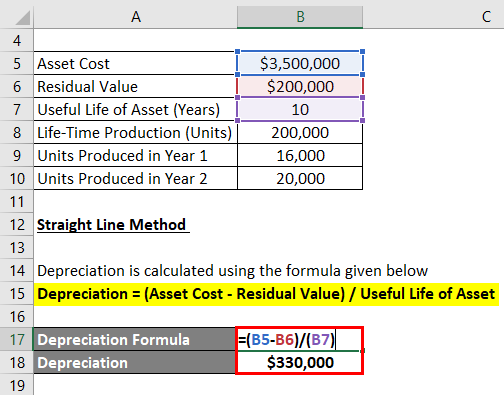

Carpet has a 10-year effective life and you could calculate the diminishing value depreciation as follows. The two methods can be understood with an example. The prime cost depreciation method also known as the simplified depreciation method calculates the decrease in value of an asset over its effective life at a fixed rate each.

With the diminishing balance method depreciation is calculated as a percentage on the book value of the tangible asset. Calculate depreciation for a business asset using either the diminishing value DV or straight line SL method. Recognised by income tax.

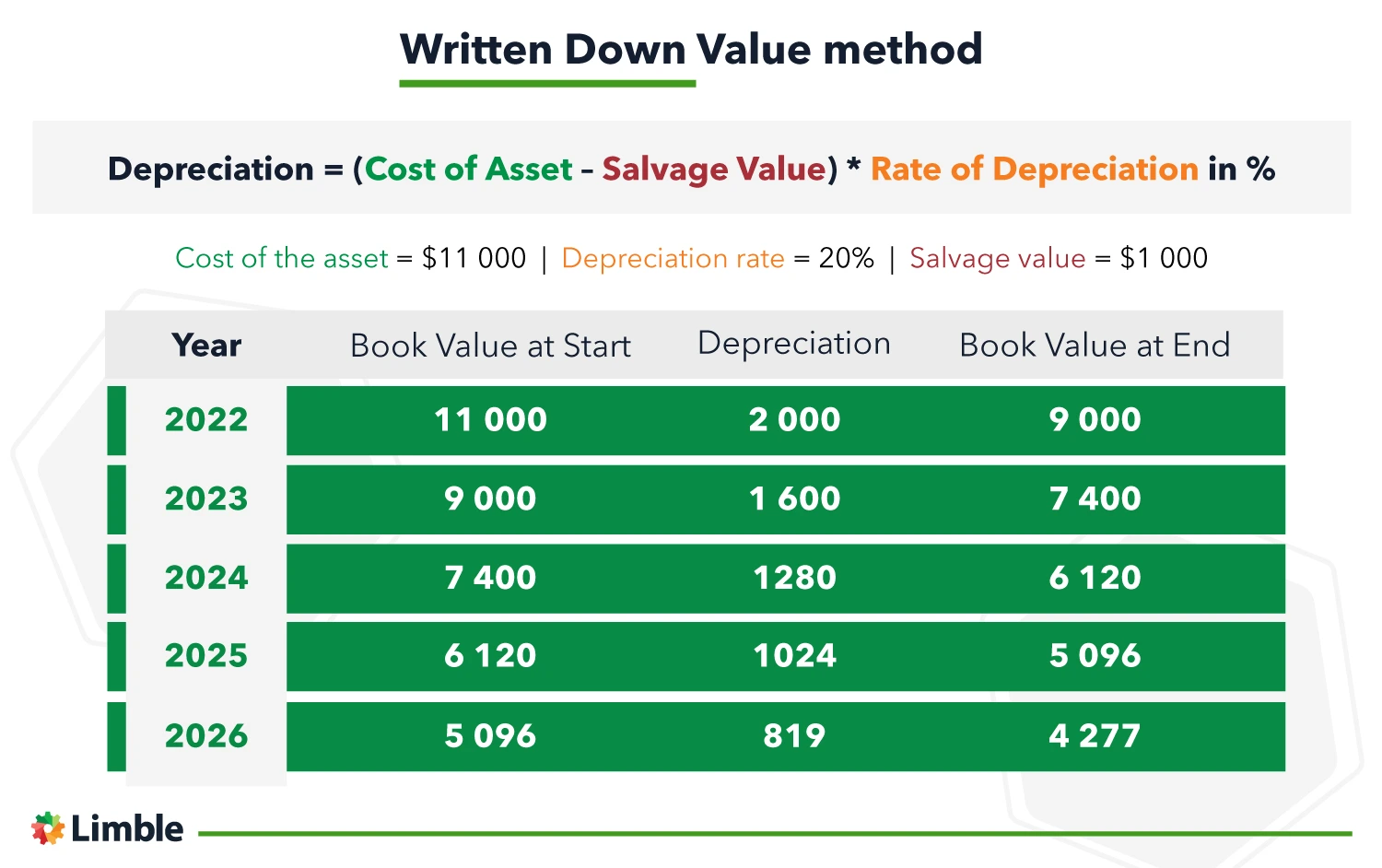

The formula for the diminishing balance method of depreciation is. Diminishing value method Another common method of depreciation is the. The depreciation rate is 60 Well here is the formula Depreciation Expenses Net Book Value.

Base value days held 365 150 assets effective life Reduction for. The diminishing balance depreciation method also results in a lower depreciation expense in the. The formula for prime cost depreciation method.

Diminishing value method The following formula is used for the diminishing value method. We already depreciated our car by 600 in the first year. In this video we use the diminishing value method to calculate depreciation.

The diminishing balance method is a. If we subtract this value 10 times the asset depreciates from 10000 to 1000 in 10 years see first picture bottom half. Base value days held 365 150 assets effective life Reduction for.

Use the diminishing balance depreciation method to calculate depreciation expenses. Depreciation expenses Net Book Value. Formula to Calculate Depreciation Value via Diminishing Balance Method The formula for determining depreciation value using the declining balance method is-.

Diminishing value method Another common method of depreciation is the diminishing value method. Year 1 2000 x 20 400 Year 2 2000 400 1600 x. This means the current.

Pre-purchase Inspection - Free Consultation -Available Weekends - Call Now. Cost value diminishing value rate amount of depreciation to. The diminishing balance method is a method of calculating the depreciation expense of an asset for each accounting period.

Depreciation Rate Book Value Salvage Value x Depreciation Rate The diminishing balance method of. SYD The SYD Sum. Diminishing Balance Method Cost of an Asset Rate of Depreciation100 Unit of Product Method Cost of an Asset Salvage Value Useful life in the form of Units Produced.

The most widely accepted method for calculating diminished value is the 17c formula. Examples of Prime Cost and Diminishing Value Depreciation Method. Ad Insurance Total Loss Dispute Settlement - Diminished Value Claims.

The rate of depreciation is 60. Base value days held 365 200 assets effective life Days held can be 366 for a leap. However when using this method we calculate depreciation based on the cars current value not original value.

Hence using the diminishing method calculate the depreciation expenses.

Youtube Method Class Explained

Declining Balance Depreciation Calculator

Written Down Value Method Of Depreciation Calculation

Depreciation Formula Calculate Depreciation Expense

Depreciation Method Diminishing Method

Equipment Depreciation Basics And Its Role In Asset Management

Depreciation Formula Examples With Excel Template

Depreciation Methods Principlesofaccounting Com

Depreciation All Concepts Explained Oyetechy

Depreciation Formula Examples With Excel Template

Depreciation Schedule Formula And Calculator Excel Template

Depreciation Formula Examples With Excel Template

Depreciation Rate Formula Examples How To Calculate

Depreciation Calculation

Depreciation Formula Examples With Excel Template

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

Depreciation Formula Examples With Excel Template